Who needs a form LLC-25?

Form LLC-25 is a weekly payroll certification for public work projects. Contractors and subcontractors fill it out at the end of every week to establish wages for the employees regarding their work hours, benefits, and taxes.

What is form LLC-25 for?

Form LLC-25 is used to keep track of weekly payroll and to calculate the wages for every employee and report it to the owner.

Is it accompanied by other forms?

It doesn’t require any addenda. You may need extra sheets for a full list of your employees.

When is this form due?

Because it is a weekly payroll, it must be filed every final working day of the week until the end of the project.

How do I fill out form LLC-25?

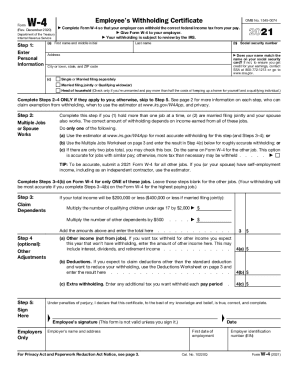

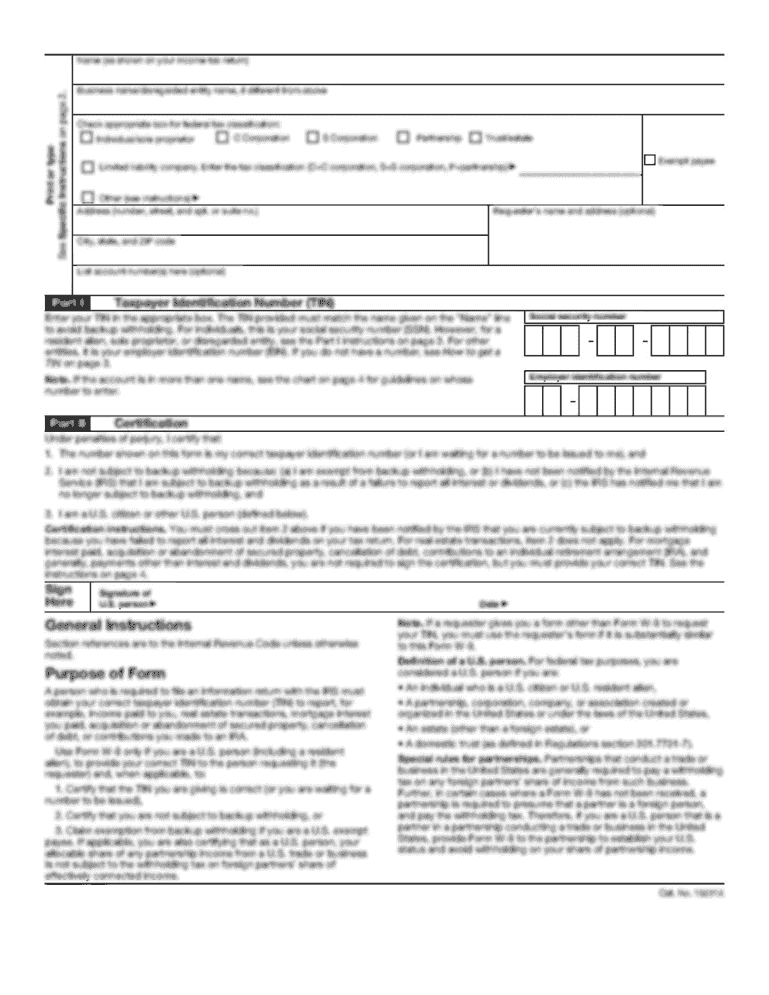

On the top of the first page you must write your name and address (check if you are a contractor or subcontractor). After that put down the payroll number, the week ending date, project location and its serial number. There is a table you need to fill out. Write the list of your employees in the first column and their work classification in the third column. Add an apprentice rate in the second column. For each employee, you have to write the amount of work hours per day, base hourly rate, total fringe benefits, total deductions, gross pay for prevailing rate job and check number. Fringe benefits may be connected to medical or hospital care, pension or retirement, or life insurance. You have to specify the amounts for them on the second page. Finally, sign the certified statement of compliance, and you are ready to send the form.

Where do I send form LLC-25?

Send it to the owner of the building and to the subcontractor if necessary.